The biggest story that no-one is talking about

At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state.—Roger Ver, anarcho-capitalist and early Bitcoin supporter.

Bitcoin: The original cryptocurrency

In 2008 the inventor of Bitcoin, Satoshi Nakamoto, expressed his view that “the root problem with conventional currencies is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”¹ This is an old right-wing libertarian talking-point: “When the state spends money to achieve social aims, it devalues money in general, which is an attack on people with lots of money.”

Bitcoin was Nakamoto’s specific application of the proposal of the book Denationalisation of Money: The Argument Refined (1976)² by an economist of the Austrian School, Friedrich von Hayek, in which he puts forward the idea that capitalists should control the production of money directly—abolishing the redistributive function of the state.

The aim of Bitcoin, therefore, was to abolish the currency-issuing role of central banks by replacing it with a currency that anyone could create (in proportion to how much computing power they could afford to buy) and which would be traded using a “blockchain”—a ledger that records all previous transactions—to prevent counterfeiting.

Bitcoin was never remotely suited as a unit of account or medium of exchange, but because it is expensive to create, and is popular with some wealthy right-wingers, it functions as a speculative asset—like a precious metal. A real currency’s exchange value, by comparison, rises and falls in proportion to how much capitalists need it for investment in new production in order to make more money; in other words, a real currency’s exchange value is a function of how useful that currency is in the production of new commodities, relative to every other currency.

China’s bright idea

The People’s Bank of China intends to replace the Chinese currency, the yuan, with something called the digital yuan—the world’s first central bank digital currency (CBDC). With a constant source of demand as a medium of exchange and unit of account in the real economy, the digital yuan, unlike Bitcoin, will actually function as a currency. In fact it is already being used in pilot schemes and is expected to act as the official currency of China by 2024–25.³

But isn’t every currency “digital,” in the sense that they are mostly held in bank accounts? Yes, but the digital yuan is different, in two important ways: It is fully traceable (by means of a blockchain), and it is programmable.⁴

To be programmable means that the currency will not be capable of being used indiscriminately for spending, investment, currency exchange, or hoarding; instead each individual digital yuan issued by the Central Bank will have software written within it that records exactly what that specific yuan can and cannot be used to purchase. In a dialectical twist that I think Marx would appreciate, Nakamoto’s blockchain, in trying to bring to life Hayek’s dream of private money without a state, instead conjured up its antithesis: history’s most ambitious state attempt to control money.

What effects can this be expected to have? Firstly, traceable and programmable currency issued by the state will be incapable of being used by criminals. If the Central Bank can see every transaction, and predetermine what every unit of currency can and cannot be used for, bad actors will be left with the choice of trying to sneak foreign paper currency into the country or trading commodities directly, using barter.

Simply imagine criminals in Ireland trying to operate without the use of the euro, either for criminal purposes or for spending purposes, and you will appreciate the effect this would have.

For the same reason, China will also become much more efficient at meeting social goals. Today, if the state decides that it wants to spend money to raise living standards in a given underdeveloped region, it knows that by the time the money trickles down through layers of bureaucracy (and sometimes corruption) most of it will not have reached those who it was supposed to help.⁵ The programmable digital currency will make the entire process of moving money completely transparent to the government. Shadow banks, which are a systemic risk to the Chinese financial system, will find it impossible to operate, along with corrupt officials, loan sharks, etc.

Much more important even than this is how the digital yuan is capable of being used to boost the economy. Whereas in China today capital controls and the strategic allocation of credit by the Central Bank are used to encourage growth in productivity, the digital yuan will allow for a much more advanced system of indicative planning. It will be possible to see exactly how companies are allocating their resources, and even pre-programming the private sector’s liquidity to limit its potential uses.

The Belt and Road, and overcoming the problem of SWIFT

China’s economic problems are born of its success in becoming an industrial superpower in a capitalist global economy. Some sectors, particularly heavy industry, have too much capacity for China’s home use,⁶ obliging them to move into foreign markets.

The mechanism by which they are exporting capital is the “Belt and Road Initiative,” aimed at installing essential infrastructure for trading partners, such as ports, railways, motorways, power stations, aviation, and telecommunications systems. The problem for China is that BRI deals are at present mostly financed through the US-controlled SWIFT payment system, denominated in dollars—which eventually find their way back to the United States in the form of demand for Treasury bonds; and so every new BRI development also helps to finance the American economy.

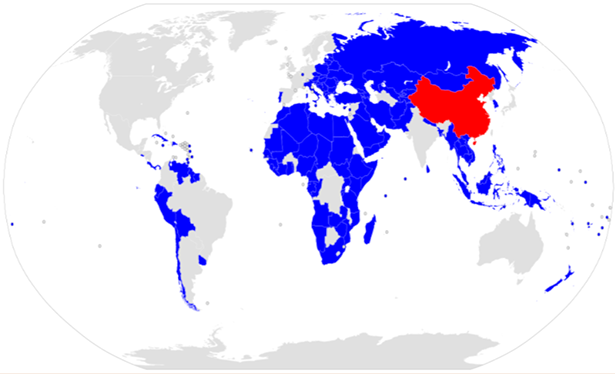

138 countries have signed co-operation documents related to the Belt and Road Initiative

In the future, China intends the digital yuan to be used as the common currency of exchange and unit of account for the Belt and Road trading bloc. Companies and individuals from anywhere in the world will be able to have an account with the People’s Bank of China by downloading an app on their smartphone and buying currency.⁷

The aim is clearly to ensure that the citizens of any country will be able to securely purchase products from the producers of any of the BRI countries using the blockchain. Trade between participating BRI countries will be revolutionised: if the sanctioned state oil company in Venezuela wants to buy a particular industrial part from a manufacturer in Russia, for example, the entire process can be handled through the digital yuan app. The units of currency can be created and programmed for use for exactly that purpose, and cannot be misallocated. The SWIFT system is not involved, and the transaction cannot be interfered with by third parties.

The digital yuan opens up new possibilities for socialist economies in capacity utilisation and price-setting.

Whatever China’s motivations for inventing it, I want to advance the proposition that a programmable currency on a blockchain can entirely replace a market of competitive prices. Firstly, the blockchain would automatically record all purchases (by retail outlets and customers) as they happen in real time. Secondly, the programmable nature of the currency means that prices can be set by auto-adjusting the currency’s exchange value relative to every specific good, based on the retail outlet’s inventory (store purchases) and customer demand levels, which have been recorded on the blockchain up to that point.

Such a system would be far more accurate than the guesswork of participants in a market, allowing for extremely precise capacity utilisation in the production economy. Planners would know what to produce, import or export, and how much, in every area; and as socially owned production is automated, goods can become cheaper and working days become shorter in unison. Society is therefore rewarded directly for advances in production techniques.

I believe that this technology can also be used for a socialist economy beyond the phase of commodity production, but this will require a separate article.

Big Tech hits back

An alternative project will see the launch this month of “diem,” a cryptocurrency designed by the Facebook company, formerly known as “libra.” Through Diem, Hayek’s original vision might yet be salvaged.

A consortium of American tech giants and financial companies will in effect act as a central bank, issuing currency by fiat.⁸ Unlike the digital yuan, the Diem tokens will be private liabilities. For the first time, such companies will be able to profit from seigniorage, the difference between the cost of production of money (essentially nil for a digital currency) and the exchange value that the issuing central bank says this money is worth!

Diem fits into the US industrial-financial strategy. Big Tech will be able to put their savings (often US Treasuries) back to work in the global economy as diems, the profits from which can be converted back into more Treasuries to finance US deficits.

References

- Alan Feuer, “The Bitcoin ideology,” New York Times, 14 December 2013 (https://tinyurl.com/y6lclpu5).

- European Central Bank, “Virtual Currency Schemes,” October 2012 (https://tinyurl.com/95dh2o7)

- Chris Devonshire-Ellis and Dorcas Wong, “When can I buy, use, and trade China’s digital yuan?” China Briefing, 20 August 2020 (https://tinyurl.com/ycqxz78h).

- Andrew Work, “China’s DCEP will be the world’s Sputnik money moment,” Forkast, 10 August 2020 (https://tinyurl.com/y85ubm84).

- Mimi Lau, “Underground banks siphon HK$245 billion out of Chinese province in a single year . . . and that’s just the tip of the iceberg,” South China Morning Post, 12 January 2016 (https://tinyurl.com/ydhhfjrc).

- Lauri Myllyvirta, “Analysis: How China’s heavy industries became ‘too big to fail’,” Unearthed, 14 February 2017 (https://tinyurl.com/ya5foc5h).

- “Why is China moving to digital RMB?” Youtube (https://tinyurl.com/yd3b7urt).

- Charlotte Geiger, “Ten reasons why Facebook’s Libra is a bad idea—and we should stop it now,” Finance Watch, 23 July 2019 (https://tinyurl.com/y9ljexyo).