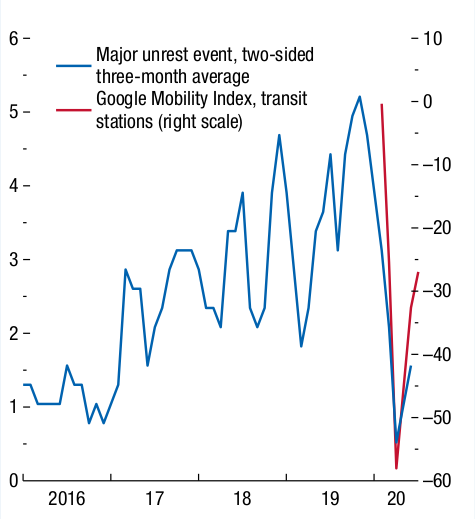

Visible manifestations of social unrest have decreased considerably during the pandemic as people are unable to meet, organise or travel. This is shown by research conducted by the IMF in Figure 1 comparing major social unrest events with mobility data. Normality may be suspended to a large degree, but the fortuitous reprise this brings for unpopular governments like our own will not last forever. An end to this pandemic fortunately appears to be on the distant horizon as multiple vaccines move towards mass production – but the economic crisis which will continue to unfold after the pandemic will not be as easy to fix.

Source: IMF World Economic Outlook October 2020. p. 40.

As life regains a sense of normalcy we can expect civil unrest on a global scale to resume where it left off, now exacerbated by the fact that we find ourselves in the first act of the next, and long-due, crisis of capitalism.

This economic crisis will heighten many underlying contradictions within capitalist economies such as our own, the very contradictions which led growing unrest before the pandemic. Some of these contradictions include the unsustainable increase in corporate debt which threaten the viability of businesses as well as financial systems in addition to significant levels of unemployment which will emerge from both the destruction of capital as well as seven years of technological adoption which has been rapidly forced on businesses since the pandemic started[1] – accelerating the productivity and hence the rate at which relative surplus value is extracted from workers[2].

Potential causes of future unrest

There are a number of potential catalysts for future unrest worth monitoring, two which are addressed here. These are steps likely to be taken by capitalist states in an attempt to avoid fiscal and sovereign debt crises. In the 26 counties we have almost 4 times as much gross General Government Debt (GGD) and over six times more net GGD than we did before the last crisis, as seen in Table 1.

Table 1: General Government Net Debt (€ millions)

| Year | General Government Net Debt – ESA2010 Code (GGNetDebt) |

|---|---|

| 2007 | 28,664 |

| 2008 | 43,051 |

| 2009 | 62,977 |

| 2010 | 111,417 |

| 2011 | 135,654 |

| 2012 | 152,282 |

| 2013 | 161,548 |

| 2014 | 167,440 |

| 2015 | 172,815 |

| 2016 | 176,643 |

| 2017 | 175,695 |

| 2018 | 177,309 |

| 2019 | 175,796 |

Source: CSO

Whilst Fine Gael and Fine Fáil obscure the truth by pretending that the economy is in good health and our debt is manageable as a percentage of GDP, the truth is that we are in considerably worse shape facing into this crisis than we were in 2008. To offer a stark contrast, our GGD stands at €204bn, exactly the same as Poland’s GGD in 2014[3]. A population of 4.9 million people is expected to shoulder the same burden of debt by the EU as a population of 38 million people.

Capitalist solution to avoiding a Sovereign debt crisis

As if this wasn’t bad enough, a recent IMF report states that:

sovereign debt to GDP in advanced economies is projected to rise by 20 percentage points to about 125 percent of GDP by the end of 2021 … The high fraction of tax revenue absorbed by debt service will necessarily mean that there is less revenue left over for critical areas, including social spending needs [emphasis added].”[4]

The high levels of debt inherited from the last crisis in tandem with more debt being accrued during the pandemic leads one to the correct conclusion that, under capitalism, austerity is the only option to avoid a sovereign debt crisis. The choice for more austerity is not a ‘bad’ decision on behalf of otherwise well meaning politicians, it will be a necessity. Servicing of odious debt, accrued to prop up the interests of capital during crises current and past, will take precedence over the needs of the people. The only response to these calls for austerity is to repudiate the debt and seek to build a socialist economy, an economy capable of rational planning and allocation to meet the needs of all – not an irrational and dangerous system which breeds poverty and inequality.

Fiscal crisis

Inherently tied to the issue of debt is the fiscal crisis we find ourselves in. This year the government borrowed €20.5bn to keep the country running during the pandemic, running a deficit of 5.7% of GDP[5]. This level of borrowing was unthinkable not long ago due to the Fiscal Compact which penalises EU members from running budget deficits in excess of 3% of GDP. The EU, which enforced this arbitrary rule with an iron fist during the last crisis, is now choosing to temporarily ignore this rule when national governments need to accrue debt to support their indigenous capitalist class. In doing so it attempts to present itself as the benevolent saviour during this crisis. As both the IMF notes, this leniency will not last:

Where fiscal rules may constrain action, their temporary suspension would be warranted, combined with a commitment to a gradual consolidation path after the crisis abates to restore compliance with the rules over the medium term.[6]

As always, austerity will return as a solution to the need to return to balanced budgets. The old rules are likely to come back into force and public expenditure will once more be denied, not on the basis of outright ideological opposition, but on the basis of ‘apolitical’ technocratic arguments. Cuts will be presented as necessary to balance the budget and the mantra of ‘there is no alternative’ will be revived once more.

Additionally, support for unemployed workers is likely to be contingent on a non-existent ‘fiscal space’, driving wages downwards and placing great pressure on the labour movement:

Because the transition may take a while, displaced workers will need extended income support as they retrain and search for jobs. Complementing such measures, broad-based accommodative monetary and fiscal responses — where fiscal space exists [emphasis added] — can help prevent deeper and longer- lasting downturns[7]

We know this song well. The only question we have to ask ourselves this time is what will we do differently?

Conclusion

Within the communist movement and the broader left we must emphasise the need to act collectively with a common strategy, the article “The Industrial Relations Act must go”[8] in this publication offers a concrete example of such a vision for regaining the tools required for collective action after decades of relative passivity. If we fail to act as a collective, whether as persons or institutions, we can expect to face the same levels of success as during the last crisis, if not worse.

We require a national strategy which is capable of exposing the supposedly neutral, apolitical economic expertise being adopted by this coalition of property developers, blueshirts and bike-riding neoliberals for what it is; expert advice on the implementation of class war. Unfortunately it is a war in which we are firmly on the back foot. To combat this we require an educated, disciplined Party working with the guidance of competent and democratically accountable national leadership to build class consciousness in our wider communities.

Thankfully we are firmly on the path towards all of these goals though there is much work to still be done. The immediate future will offer many challenges and is likely to bring with it significant social unrest. Fortunately, those challenges will provide opportunities for the growth and development of the CPI, the wider left, and – if we can rise to the task – a hope for a better future for Ireland as a whole.

Footnotes

- McKinsey & Company, “How covid-19 has pushed companies over the technology tipping point—and transformed business forever”

- Karl Marx, Capital, vol. 1, chap. 12.

- Eurostat, “General government gross debt: Annual data”

- International Monetary Fund, World Economic Outlook, October 2020, p. 13.

- Paschal Donohoe, “Statement of the Minister for Finance,” 13 October 2020

- International Monetary Fund, World Economic Outlook, October 2020, p. xvii.

- International Monetary Fund, World Economic Outlook, October 2020, p. xvii.

- Jimmy Doran, “The Industrial Relations Act must go,” Socialist Voice, November 2020