A strange thing happened in OECD countries between the 1970s and 2008: economic growth rates that looked poor on paper compared with the 1950s and 60s seemed to be boosted dramatically by a massive subsidy, somehow hidden from all national accounts statistics.

That subsidy, it turns out, was cheap labour and rapid automation in the manufacturing centres of the Global South. What western governments discovered was that, as long as imported goods of all kinds could continue getting cheaper, year after year, a lower and lower profit-wage share going to labour could be sustained without any fall in the real purchasing power of workers in their home countries.

Indeed it became a virtuous cycle for “core” capitalist countries. Consider how states tax imports and then tax their domestic circulation, along with taxing of all the services that wouldn’t exist without the imports (retail, marketing, finance, consultancy, training, etc.). What these governments found was that amid apparently falling domestic growth rates they had such boosts to their coffers that they could maintain aspects of their welfare states even as they looted their own public domain by privatising public services and assets.

So it was that two global economies were created during this period, not one. Businesses in the Global South had to compete among themselves to produce low-cost goods for sale to the economies of the core capitalist countries, and hence, even as their productive capability became more advanced, they had to keep repressing their workers’ wages, sacrificing domestic development for “labour market competitiveness.” Firms in the capitalist core formed a separate layer of competing companies, dependent on but not in direct competition with their counterparts in the Global South.

The problem with capitalism, however, is that you eventually run out of other people’s surplus value. It comes down to the central problem, which Marx identified about 170 years ago: the falling profit rate. The exchange value of goods is determined by their cost of production; and when this falls below a certain level (because of automation) the internal regulating mechanism of the system—the profit motive—breaks down, making further private investment in automation nonsensical.

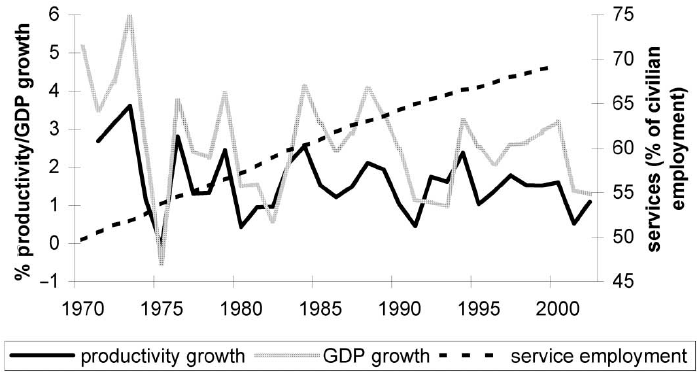

The investment therefore tends to flow into the service sector instead, which is incapable of sustaining profit growth (growth in extraction of surplus value from labour) in the way that offshoring and automating the factories of the twentieth century once did. In fact where services do achieve, or aim to achieve, that kind of growth it is only through monopolistic control over markets: think of Amazon, Airbnb, Google, Facebook, or Uber—the very definition of competitive capitalist market economies breaking down.

As Aaron Benanav of Humboldt University, Berlin, put it in non-Marxist language:

The real cause of the persistently low demand for labour is the progressive slowdown of economic growth since the 1970s, as industrial overcapacity spread around the world, and no alternative growth engine materialised—a development originally analysed by Robert Brenner, and belatedly and obliquely recognised by mainstream economists under the name of secular stagnation or Japanification.

It turned out that you can have a significant economic expansion based on paying other people a lot less to do much of the labour that your economy would otherwise have to undertake itself. In such a situation you can even pay your workers in their low-value-creating service jobs the full value of their labour, or even more than its full value! Such workers can think of themselves as no longer being in the proletariat at all, so well does the system appear to work for them. As long as the surplus value is extracted somewhere else, by apparently unrelated people doing unrelated jobs half a world away, the system can remain profitable.

The “industrial overcapacity” identified by Benanav is at the root of what we have come to know as the “gig economy.” The tap that allows for a constant stream of surplus value to make its way to the economies that Charles Maier of Harvard University called the “Empire of Consumption” has not been turned off, but the flow has been slowing for twelve years now.

Where, then, to find the profits that both private business and the capitalist state rely upon? The only viable option is to raise the rate of domestic exploitation, i.e. find ways to make labour cheaper at home in order to make up for the reducing gains from automation that characterised the era of globalisation.

In many ways it is shocking how little the left and trade union movement here in Ireland have reacted to the hundreds of thousands of permanent work positions domestically that have quite suddenly become part-time, temporary work, agency work, banded-hours contracts, independent contracts, and so on. After all the hard-fought industrial struggles of the twentieth century it is startling that a company like Uber or Deliveroo can simply say, “We don’t have employees, we have riders”; and so those workers, in one stroke, have no labour protection.

The truth is that the “gig economy” is simply capitalism in its standard form, within its regulatory framework, operating normally; the new profits have to come from somewhere. The era of globalisation was one of brutal exploitation, but it was only happening in other places. As we enter the post-covid era, with globalisation in headlong retreat, the “gig economy,” now standing at about 10 per cent of Irish employment, and growing, will start to simply become known as “the economy.” In the 2020s the class struggle is back on, but so far only one class has been launching offensives.