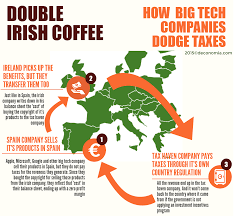

Recent research on the profits declared in Ireland, and the subsequent taxes paid on those profits, should surprise no-one. It has exposed the fact that American transnational corporations made $83 billion (€74 billion) in profits here. A third of them have their head office here, so they can declare all their global profits in Ireland and so avail of the generous tax policies of the Irish state.

While the nominal tax rate is in or around 12½ per cent, the effective tax take is in the region of 4.8 per cent. The Irish state remains the No. 1 tax haven for American transnationals.

It is estimated that the tax revenue received by the state from these declared profits is more than €14.3 billion since 2015. We are net beneficiaries of both the global imperial plunder and savage exploitation of workers in the global south and the super-exploitation of the natural world that contributes to the destruction of the global environment.

It also means that the Irish state’s revenue is of a very precarious nature, totally dependent on the tax code being maintained as it comes under pressure from more and more countries that either oppose these tax levels and want to increase taxes on corporations or are attempting to follow a similar job-creation strategy, thereby engaging in a race to the bottom.

This economic development strategy being pursued by the the Irish ruling class can only lead to a very precarious financial situation for the state, making it even more vulnerable to the flight of capital as these corporations scour the world for the best deal so as to pay minimum or no tax.

It means that precarious employment is a growing feature experienced by workers as this state competes for mobile capital in globally traded goods and services. There is clearly no strategy for building a sound industrial base on the sustainable use of the natural world and Ireland’s skilled and educated work force.

As with all things under capitalism, maximum profits are the order of the day. We know from experience when government finances decrease it is workers, pensioners, the sick and children who pay the price.